GEC had its origins in the G. Binswanger and Company, an electrical goods wholesaler established in London in the 1880s by a German-Jewish immigrant, Gustav Binswanger (later Gustav Byng). Regarded as the year GEC was founded, 1886 saw a fellow immigrant, Hugo Hirst, join Byng, and the company changed its name to The General Electric Apparatus Company (G. Binswanger).

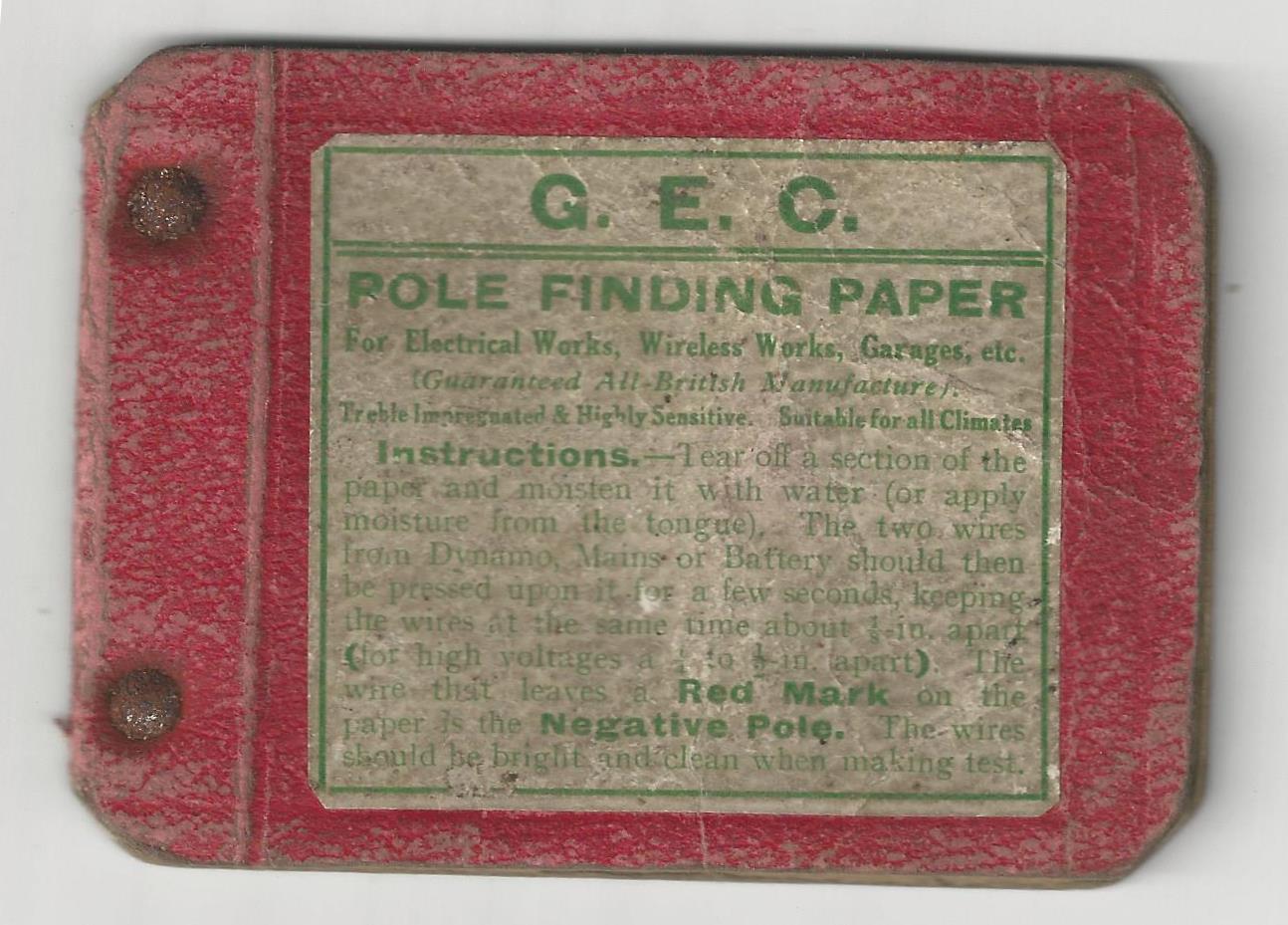

Their small business found early success with its unorthodox method of supplying electrical components over the counter. Hugo Hirst was an entrepreneurial salesman who saw the potential of electricity and was able to direct the standardisation of an industry in its infancy.

In 1889, the business was incorporated as a private company known as General Electric Company Ltd. The company was expanding rapidly, opening new branches and factories and trading in 'everything electrical', a phrase that was to become synonymous with GEC.

In 1893, it decided to invest in the manufacture of lamps. The resulting company, (to become Osram in 1909), was to lead the way in lamp design, and the burgeoning demand for electric lighting was to make GEC's fortune. In 1900. GEC was incorporated as a public limited company.

The outbreak of World War I transformed GEC into a major player in the electrical industry. It was heavily involved in the war effort, with products such as radios, signal lamps, and the arc-lamp carbons used in searchlights.

Between the wars, GEC expanded to become a global corporation and national institution.

In World War II, GEC was a major supplier to the military of electrical and engineering products. Significant contributions to the war effort included the development in 1940 of the cavity magnetron for radar,[

In 1961, GEC merged with Sir Michael Sobell's company, Radio & Allied Industries Ltd., and with it emerged the new power behind GEC, Sobell's son-in-law Arnold Weinstock, who became the managing director of GEC in 1963. Weinstock embarked on a programme to rationalise the entire UK electrical industry, beginning with the internal rejuvenation of GEC.

In the late 1960s, the electrical industry was revolutionised as GEC acquired Associated Electrical Industries (AEI) in 1967, which encompassed Metropolitan-Vickers, British Thomson-Houston (BTH), Edison Swan, Elliott Brothers, Siemens Brothers & Co, Hotpoint, W.T. Henley, and Birlec.

In 1968, GEC merged with English Electric, incorporating Elliott Brothers, the Marconi Company, Ruston & Hornsby, Robert Stephenson and Hawthorns, the Vulcan Foundry, Willans & Robinson and Dick, Kerr & Co.

GEC had become the UK's largest and most successful company and private employer, with about 250,000 employees. By the mid-1990s GEC was making profits of £1 billion, had cash reserves of £3 billion, and was valued at £10 billion.

The move towards electronics and modern technology, particularly in the defence sector, was a departure from the domestic electrical goods market. GEC acquired the Edinburgh-based Ferranti Defence Systems Group in 1990 as well as part of Ferranti International's assets in Italy.

Lord Weinstock retired as managing director in 1996 and was replaced by George Simpson, who embarked on a number of US mergers and acquisitions.

After most of its US acquisitions failed, GEC began to make a loss. The cash reserves Lord Weinstock had built up during the 1980s and early 90s had all but gone, and the company was heavily in debt.

A merger of UK companies soon became the most likely development. In mid-January 1999, GEC and British Aerospace confirmed they were holding talks. On 19 January, it was announced British Aerospace was to acquire Marconi Electronic Systems for £7.7bn

While the deal was yet to be completed, GEC used much of the anticipated proceeds of the MES sale to buy companies in 1999. This was part of a major realignment of the firm to focus on the burgeoning telecoms sector, and it became a radio, telecommunications and internet equipment manufacturer.

A number of US acquisitions were made at the height of the dot-com bubble, and the bursting of the bubble in 2001 took a heavy toll on Marconi. In July 2001, Marconi plc suffered a 54% drop in its share price following the suspension of trading of its shares, a profits warning, and redundancies. Its managing director Lord Simpson was forced to resign.

On 27 October 2006, the company folded voluntarily.